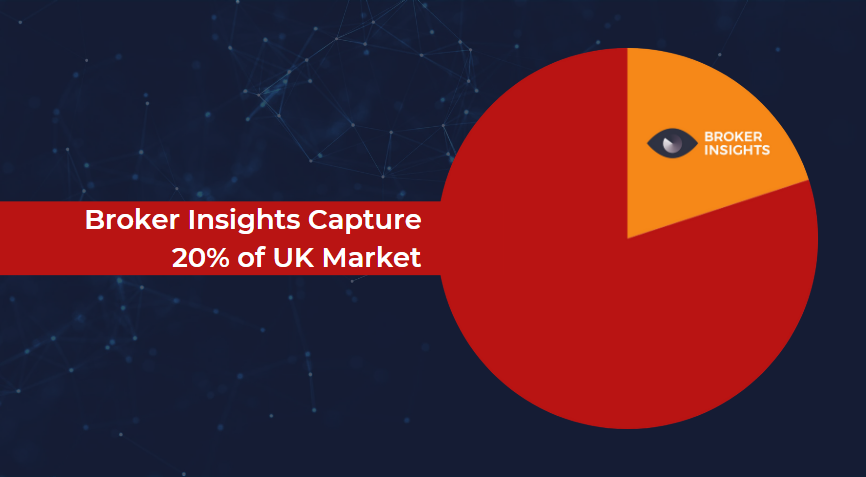

Broker Insights has today announced the rollout of a major upgrade of its market-first data platform. At the same time the platform, which brings brokers and insurers together, now has more than £2 billion gross written premium of the UK commercial insurance broker market and over 20% of the British regional broker market.

The platform, which has a new name of ‘Broker Insights Vision™’, has new features and functionality and maximises data from the system for all kinds and sizes of brokers and insurers.

“We are using data to transform the industry with a system that manages and optimises placement for all kinds of brokers, while creating a far more efficient trading relationship between intermediaries and insurance providers,” said Chief Executive, Fraser Edmond.

“Enterprise-level brokers have teams of people and in-house systems that try to manage placement across their organisation. For the first time Vision opens up our independent industry-leading solution to all intermediaries.”

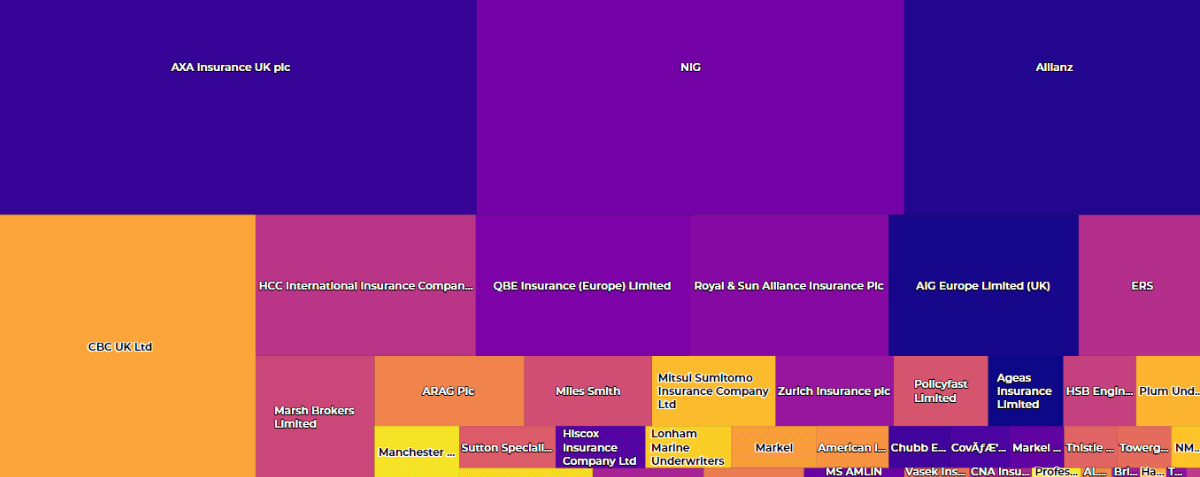

Broker Insights is based on the “intelligent-matching” of brokers and insurers, and this remains at the heart of the new platform’s functionality. The platform provides brokers with placement opportunities drawn from insurers’ appetite, while offering insurers a redacted view of brokers’ risks. This supports both distribution and placement efficiency gains for both sides.

The ‘Broker Insights Vision™ platform is currently being live-tested by broker partners, with a full rollout to all broker customers once the trials end shortly.

Founded in 2018, Broker Insights had a successful Series A funding round in 2021. With the new backing, the team expanded to 60 people and the company invested in its data science capabilities and analytics tools.

Vision uses macro historic placement data to indicate the likelihood of insurers accepting risks. This modelling, which shows the propensity for the placement of risk, is a new addition to the platform and uses machine learning to predict events.

Vision will also enable brokers to set and manage their placement strategy across their organisation using simple and easy-to-use tools to explore the implications of their decisions.

“With this latest version, we really thought about what brokers are trying to achieve. We’ve split our customers out into their missions. For the likes of owners, directors and those responsible for placement who are looking for a higher-level view – the system allows them to set strategy and measure performance. We also have a much more day-to-day view for account handlers.”

Alan Sanderson

Chief Commercial Officer, Broker Insights

Broker Insights has also set up a team to ensure brokers get the most out of the new version of the platform.

“Vision delivers gains across the renewal lifecycle, driven by the enhanced use of data,” added Alan. “Each risk can be managed against strategy via a new workflow feature, allowing the account handler to manage actions for upcoming renewals.”

The Vision platform also introduces a new upsell and cross-sell capability. This uses macro data views to inform the broker of customers’ coverage gaps. If the renewing insured does not have the cover in place, Vision will provide a notification along with market opportunities.

Fraser added: “We are using predictive analytics to provide brokers with the tools to manage their placements more effectively, providing real-time data to help them sell more products, improve earnings with insurer partners, and save staff time by working with the insurers and managing general agents that truly want to do business with them.”

Currently over £2 billion of commercial broker GWP is on the platform, and of this figure, £1.6 billion is from the £8 billion regional broker market.

UK Website

UK Website USA Website

USA Website