VISION for Brokers

Reveal the best placement opportunities and place more business with key partners.

VISION for Insurers & MGAs

Discover untapped market opportunities, increase your efficiency and boost your bottom line.

MatchPoints™

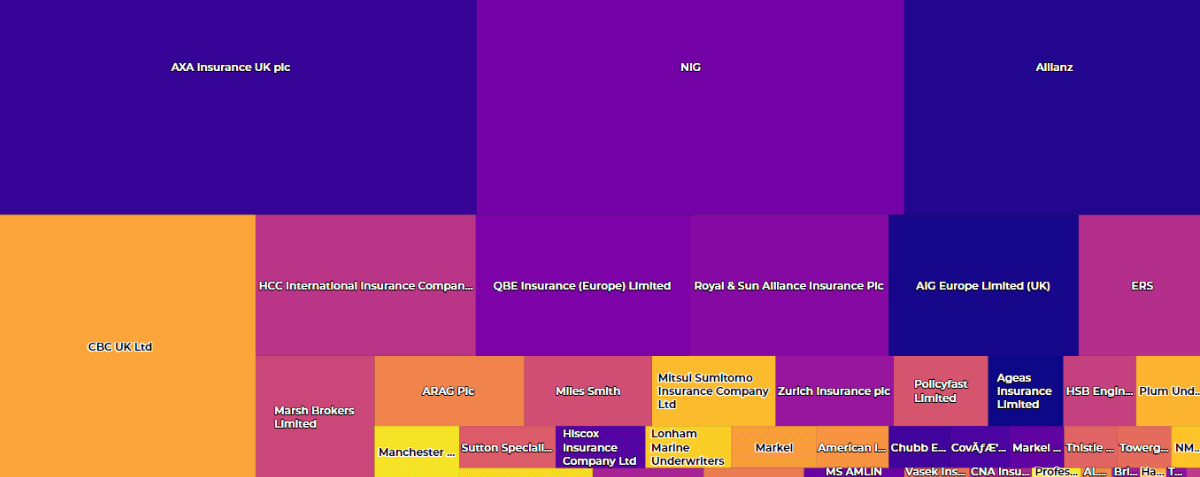

MatchPoints™ uses key data points to intelligently match the right broker risk, with the right insurers, at the right time.

Resources

Blog

Keep up to date with the latest industry blog posts.

Analysis of our large dataset has a shown that premiums are softening in the market...

Case Studies

Hear how our brokers and insurers use VISION.

Over the past decade, Riviera Insurance Services has experienced fast growth, evolving from a three-person...

Newsroom

Read about us in the commercial insurance news.

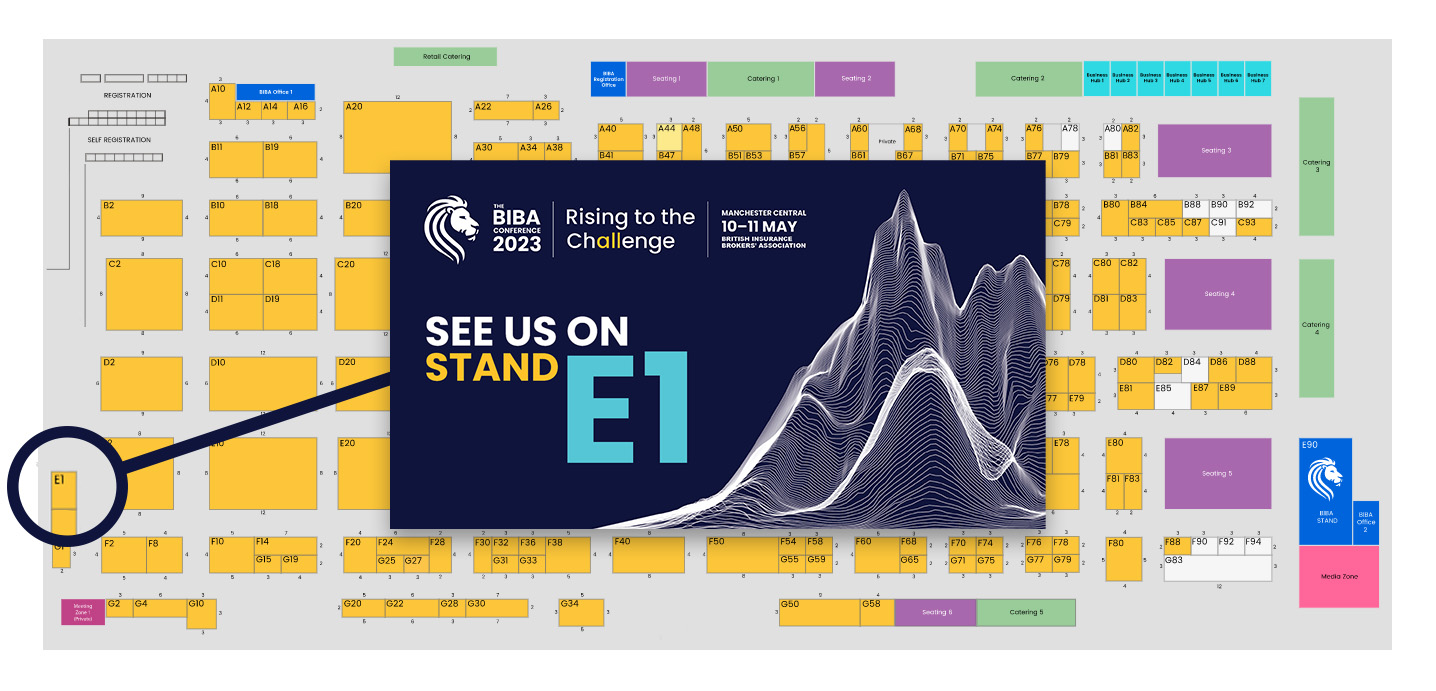

Dundee, UK, 8th April, 2025 – Broker Insights, the leading provider of insurance data analytics...

About

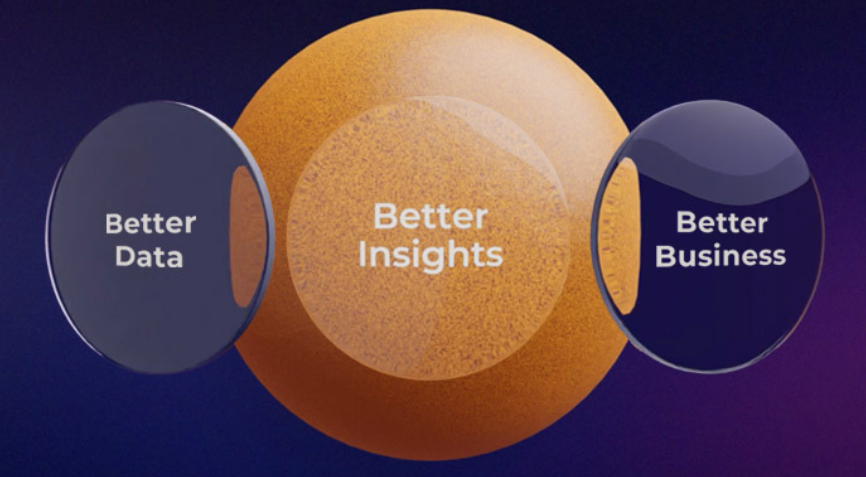

Empowering Brokers and Insurers through data-driven decision-making.

Join our Vision for a stronger future in commercial insurance.

UK Website

UK Website USA Website

USA Website