Our CEO, Fraser Edmond, talks digital innovation and its impact on commercial insurance…

The commercial insurance sector has been slow to embrace digital innovation. I think we will start to see an acceleration of the use of technology as insurers and brokers seek new efficiencies and adapt to new ways of working. As part of this shift, as an industry, I believe our challenge is to retain a strong sense of community because it is one of the greatest assets we have.

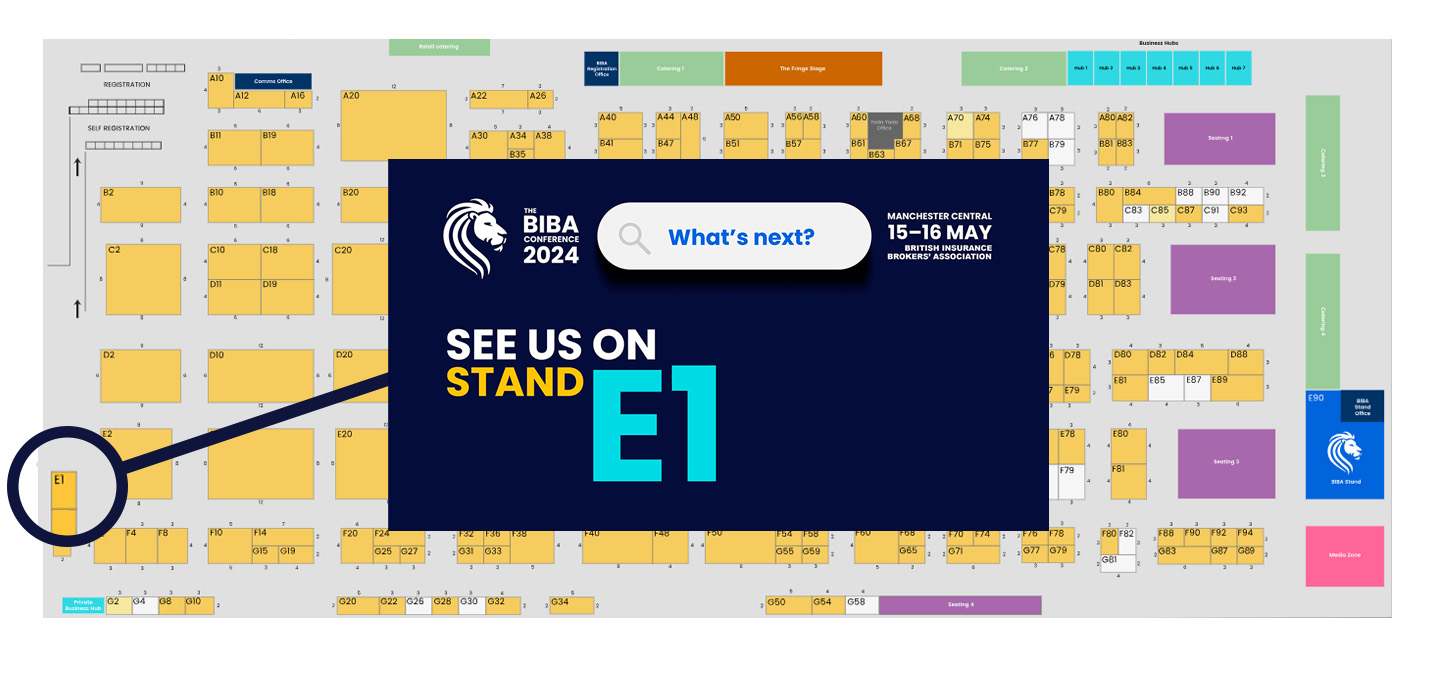

Working closely with regional brokers and insurers, we continually hear the industry is based on relationships. Yet, we also here from regional brokers they don’t get the attention they need while insurers don’t have means to reach everyone. With a move toward more digital interactions, at Broker Insights, we find ourselves in a unique position because we are helping insurers and regional brokers transform their relationships using smart, data-led platform interactions.

The platform interactions won’t replace in-person interactions. Our feedback has been that brokers on our platform are making connections and working with insurers who they did not previously have relationships with. Whether it’s new or an existing relationship, we want to enrich these interactions.

Solving a problem

Regional brokers want to spend more time with their customers to understand their risks and needs and provide risk advice and the right insurance cover. Allowing brokers to focus their time and limited resources on their customers is one of our underlying goals as well as extending insurers distribution reach and their ability to zoom in to find the right opportunities and build a customised pipeline.

By enabling brokers to spend more time with their customers, they may reduce time with insurers. That might sound as if it’s at odds with improving broker insurer relationships. Yet the key to this is quality of interaction: a broker speaking to the right insurer with the ‘heavy-lifting’ to match the broker opportunities with an insurer who has the right appetite done in advance. The digital interactions are informed so that by the time they are speaking directly, the conversation is laden with value that sparks a long-term relationship.

Because we want to create value for insurers and brokers and built a platform in which value can be created and exchanged, the platform makes interactions between insurer and broker’s easier. We are unlocking new sources of value for the insurance community and creating interactions on the platform that historically were face to face or over the telephone.

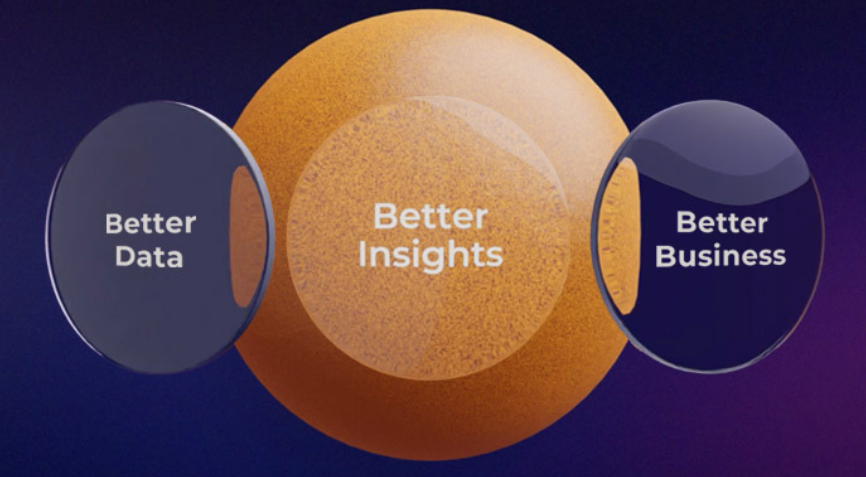

Valuing the power of data

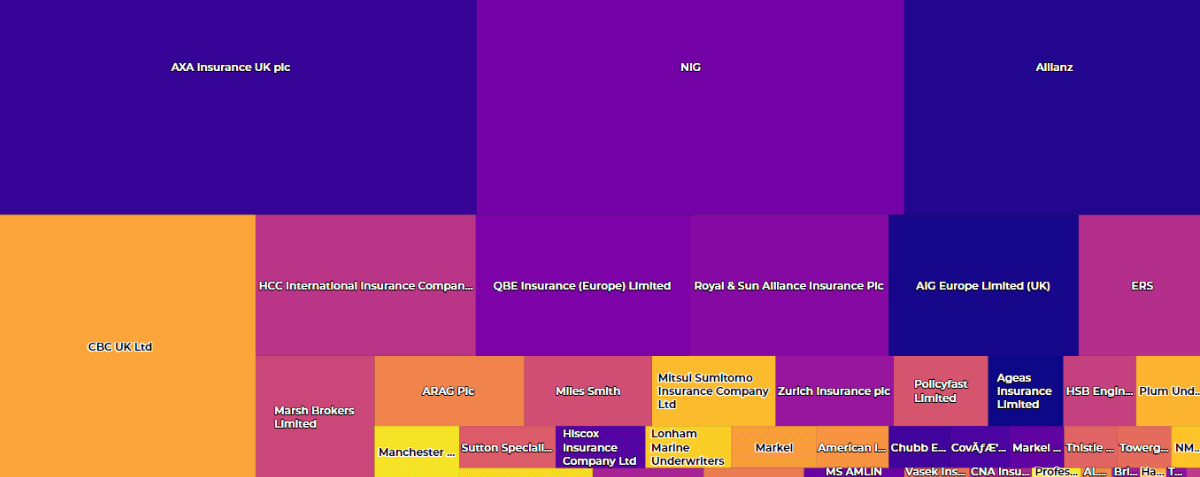

Our commercial insurance distribution and data platform securely hold brokers’ customer policies data. Before the platform was available, we believe insurers had difficulty finding potentially valuable in-appetite opportunities amid the noise of the whole market. It is a data-led approach that produces value for brokers and insurers by making it easy for them to make connections and have meaningful interactions. The insight the platform gives also helps brokers develop and manage their placement strategy and enables insurers to profile the UK commercial insurance market with certainty. The data and insight facilitate better business decisions than just instinct and anecdote.

Serving the commercial insurance community

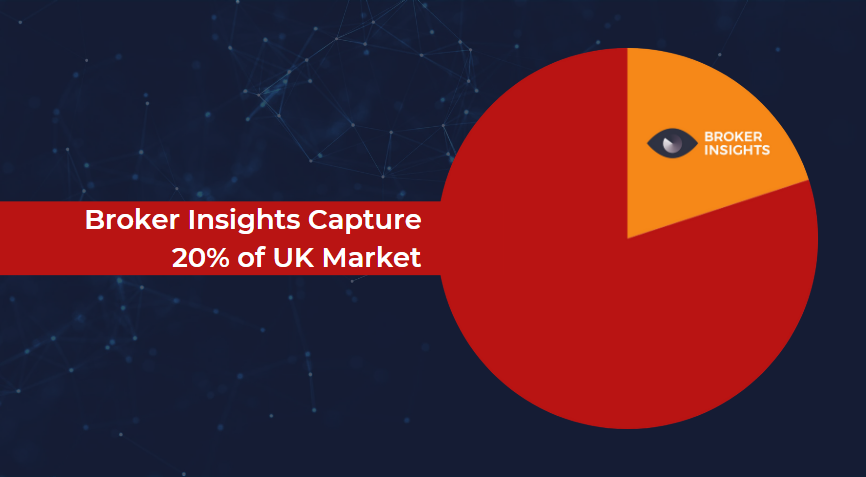

The insurers and brokers are the participants of the platform – they are the community. For us, as a platform business, it’s all about facilitating the interaction within our community of partners. It’s essential we fairly manage the value amongst the participants. As more brokers join, there are more opportunities for insurers; with more opportunities, insurers are increasing their usage, leading to more broker placement choices. It’s a virtuous cycle, and we are continually looking at ways to add value for our partners.

Community Traits

We believe it’s desirable to have users participate in shaping the system that supports them. We work closely with our insurer and broker partners with surveys, a Platform Champion Program and a Strategic Advisory Board where we regularly get feedback and discuss the direction of the platform.

An essential part of what Broker Insights does is ensuring the quality of data to make sure participants can trust the information. We need to present the information to insurers in an insightful way to surface and help them find the right brokers with the right opportunities. We are also developing user-generated content, a new source of value for participants that were not available before. We have found certain insurer users are building their social currency – the measure of the value of the relationship – as they make their reputation for good interactions with brokers.

Summary

In a changing world and digital age, our community helps connect commercial insurance brokers and insurers, allowing businesses to focus on what they are great at. The community is more important to us than many traditional companies because our purpose is to make matches among brokers and insurers through the exchange of commercial insurance insight, thereby enabling value creation for our partners.

Fraser Edmond, CEO

UK Website

UK Website USA Website

USA Website