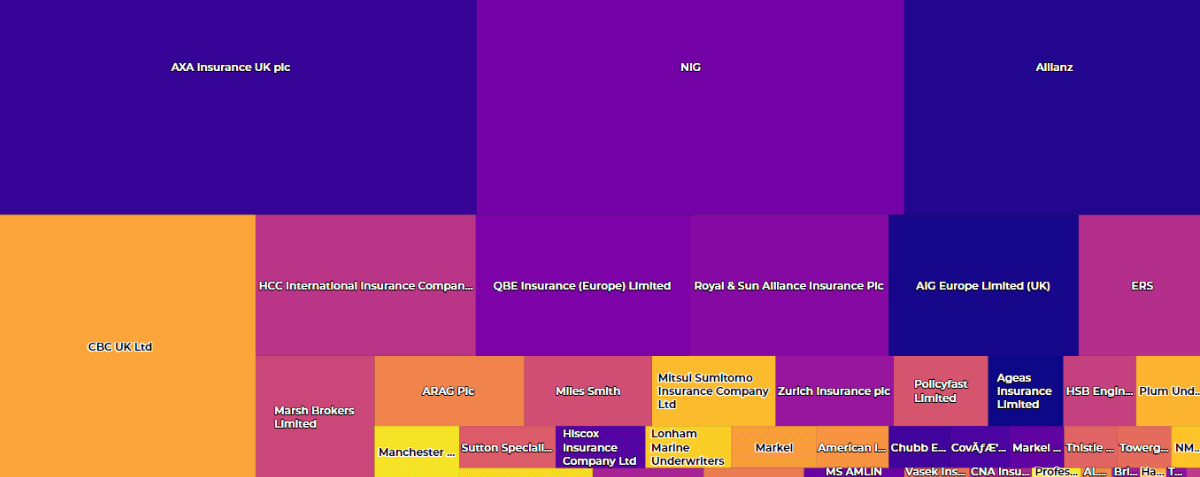

The data team at Broker Insights has been looking into agency management and has found that a majority of brokers are placing 80% of their GWP with less than 20% of their agency base.

With an average agency base of around 65 insurers, this means that many brokers are managing a large number of agencies for less than one fifth of their GWP. In some cases, a firm can maintain an agency to place a single policy.

Agency management can be a hidden cost for brokers, as the time and resource required to manage each trading relationship is often not accounted for. A large agency base can impact on a broker’s ability to engage effectively with insurers and may also have a detrimental effect on customer service due to resource constraints.

The time and effort required to manage a large number of agencies, often for a small number of policies, will ultimately impact upon a firm’s ability to maximise profits and resources.

Broker Insights provides a data-drive solution to this wide-reaching challenge. Users of the platform can access an enriched view of their data via the Placement Strategy screen and review their agency base including the number of live insurers, number of policies and total GWP.

The Broker Insights platform also allows users to identify insurer’s risk appetites and match up policies with insurer partners within the platform. The information available via the appetite overlay feature supports brokers in their efforts to drive efficiencies and reduce agencies by reviewing their placement strategy.

Alun McGeoghegan, head of insurer relationships at Broker Insights, believes that use of the management information capabilities within Broker Insights helps both brokers and insurers to achieve the best outcomes for all parties:

“With data being a hugely valuable commodity for brokers, it follows that brokers should have the most advanced tools available to manage their data.

“Broker Insights supports brokers in maximising the value of their data. Placement strategy overlays and Notes of Interest allow both brokers and insurers to connect directly over ‘in appetite’ risks and bypass the legwork and inefficiencies associated with traditional processes.

“Enhanced management information via the Broker Insights platform will help firms review their placement strategy and rationalise their agency base, to secure the operational benefits of moving more cases to insurer partners within the platform and placing more of their business in fewer markets.

“This transformational shift in the connection between brokers and insurers is serving to redefine the way that the market operates, helping to match the right parties together, who can then focus on appropriate solutions for the end customer.”

Dave Smith, head of sales at Broker Insights, outlines the beneficial impact of data in supporting agency rationalisation:

“Most brokers are aware of the need to streamline their agencies to help reduce costs, maximise profit, and mitigate compliance and oversight obligations. What is often less obvious is how to go about it.

“Broker Insights works closely with brokers to better utilise their data and extract further value from it. Our team of Business Relationship Managers can work with firms to review their placement strategy and rationalise their agencies via the use of data insights, management information dashboards and the ‘appetite overlay’ feature.”

For further information, contact the team at Broker Insights.

UK Website

UK Website USA Website

USA Website