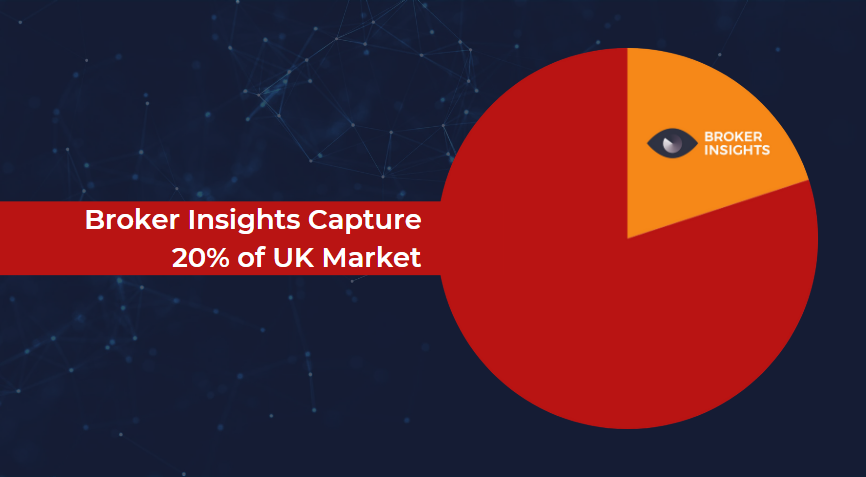

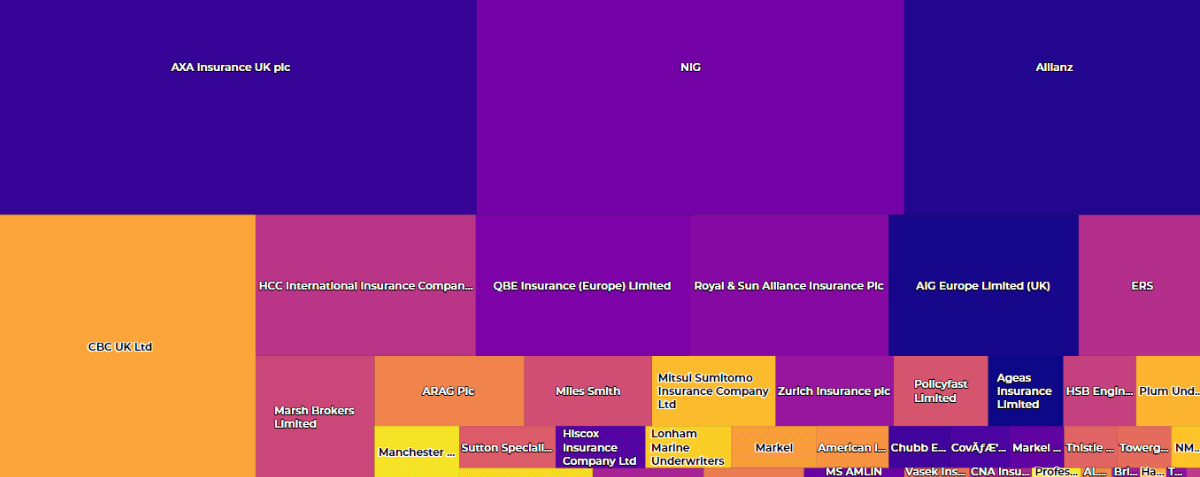

It’s almost unbelievable and somewhat alarming that the Broker Insights platform now collectively has over 1,000 placement markets!

This milestone highlights the complexity brokers face when managing placement. With over 1,000 carriers [and growing] to choose from, the UK commercial market is an intricate sector for brokers to navigate.

Analysis of data within the platform shows that brokers hold an average of 69 agencies, ranging from a handful right up to several hundred. The data analysis also showed that on average:

- Brokers hold 14 agencies that only have one policy placed

- Brokers hold 33 agencies with less than five policies placed

This analysis suggests that on average, brokers only actively utilise around half of their agency base.

Brokers are keen to support clients and will seek out markets for niche business, but at what cost for the firm itself? What analysis is being completed on the on-cost for maintaining a large number of agencies and the profitability of business placed?

If a broker maintains an agency for a handful of policies, the on-cost of maintaining the agency may be greater than the commission being received…!

Each agency must be subject to a Terms of Business Agreement and the ongoing relationship maintained in line with that agreement, each product reviewed, and policy wording understood, governance tasks undertaken, back-office account queries managed, and relationships built. Holding a large number of agencies is a significant undertaking.

Why is this so important?

Broker Insights has continually encouraged our broker partners to conduct placement strategy reviews via the platform, to explore opportunities to rationalise agency holdings and benefit from placing business in fewer markets.

There are several reasons why this topic refuses to go away and why it is extremely important for firms to address, specifically:

- Managing agencies each year carries a cost. While it’s impossible to define the cost in pounds and pence, there is a definite cost in resources. Ensuring that policy wordings are understood, due diligence is undertaken, regulatory obligations are met, accounts reconciled, etc.

Fewer markets equal fewer ‘on-costs’, which carries a knock-on effect for efficiency and profitability.

If a firm can move business from barely used agencies to core markets, they mitigate oversight and governance obligations, streamline processes, and stand to benefit from increased efficiency.

- There are potential PI implications to consider. The on-costs of a large agency base may well impact a firm’s PI renewal. We understand that PI providers can request enhanced due diligence for the steps being taken by a firm to manage a large agency base. We also understand that for some insurers, it will also depend on the conditions in the TOBA and the distribution model with particular emphasis on market security or non-UK rated insurers.

The likelihood of a PI issue arising will increase with increased complexity, which explains the potential impact on renewals, which is worsened if the firm cannot provide suitable supporting material demonstrating the steps being taken to mitigate risks.

- Regulatory concerns. The regulator does not stipulate the number of agencies a firm can hold, but we are hearing of instances where a regulatory visit has included comments in relation to overseeing a large agency base. According to Nikki Bennett, MD, UKGI Compliance Consultancy: “While there is no published guidance from the FCA regarding the number of agencies a firm can have, the regulator will expect to see appropriate systems and controls. This includes but is not limited to

- “The challenges of TOBA management which can be a laborious task, with inconsistencies across agreements which must be complied with once signed including the arrangements for handling insurance monies.

- “There is also the challenge of evidencing adequate due diligence for all parties in the distribution chain at the outset and on an ongoing basis, along with demonstrating robust product governance arrangements for all products (niche or otherwise) including suitability for the target market, aligned with their responsibilities as distributor / co-manufacturer.

- “Plus, enhanced regulatory reporting can also be affected by significant numbers of agencies or complex distribution models including EEA/Gibraltar insurers.

“Keeping it simple wherever possible is far more favourable from both a cost and a risk management perspective and this is where we find brokers need the most support.”

How can Broker Insights provide support?

Professional brokers will seek out markets for niche cases and will always place business with a market that is right for their client at that time. Over time, niche business once placed with a particular market may increasingly benefit from improving claims experience, or the widening of Insurer appetite, making it target business for our partner Insurers.

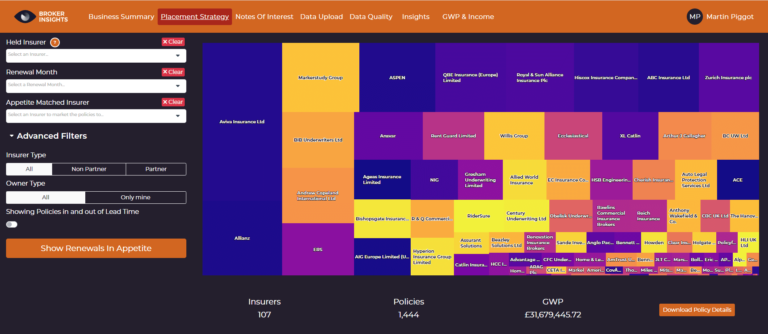

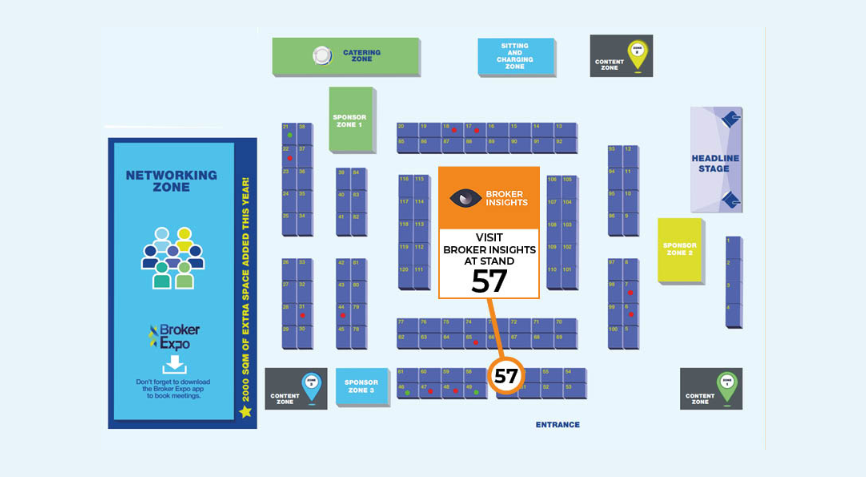

Brokers are encouraged to use the platform to identify market opportunities for their renewals. The Broker Insights’ Trading Team can help firms maximise their use of the platform, including the Placement Strategy page which can be used to review a firm’s held book.

Upcoming renewals can be analysed and referenced against our insurer partner’s underwriting appetites, with the platform highlighting opportunities to move business placed with smaller agencies via intelligent matchmaking.

If your firm would like to explore the platform’s functionality and benefit of placing more business in fewer markets, contact the team at Broker Insights today.

UK Website

UK Website USA Website

USA Website