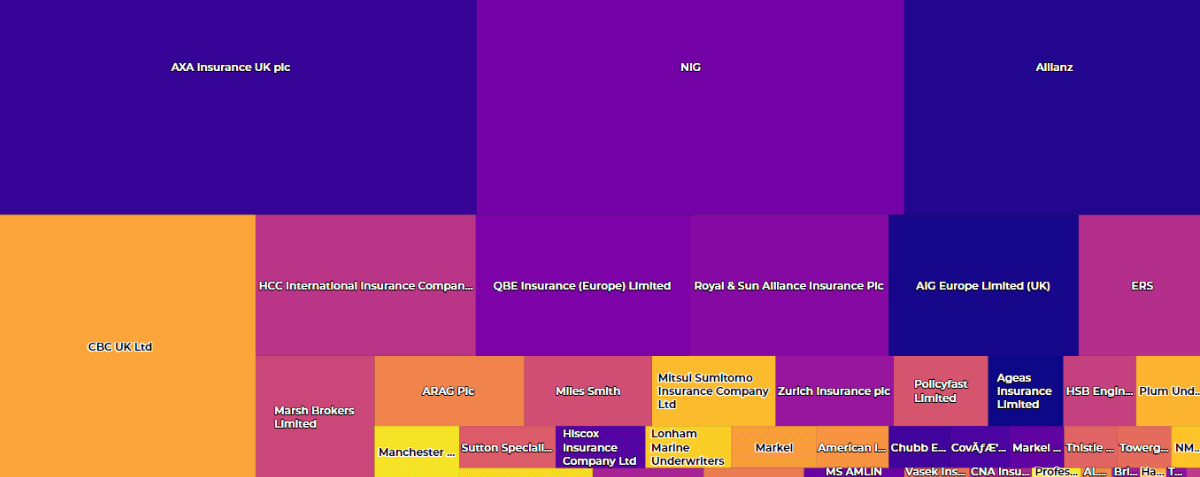

The complexity of the UK commercial insurance sector continues to grow, with more than 7 million policies placed annually, and a rising policy-per-customer ratio, driving a significant increase in the volume of renewal proposals being issued. With the sector being served by over 1,000 different market options, and brokers holding an average of 69 agencies, it is easy to understand why enhancing broker-insurer connectivity is vital.

Traditional approaches to insurer-broker engagement such as face to face meetings, call centres, appetite guides, and verbal communication, are essential components of market dynamics.

However, most traditional approaches are also prone to the ‘recency effect’, which suggests that individuals are 1.5 times more likely to remember recent conversations over older, potentially more relevant information.

This cognitive bias causes people to overemphasise the most recent information, often at the expense of more accurate, comprehensive data, with studies showing that the recency effect can distort judgment and decision-making, leading to inefficiencies.

The Broker Insights Vision™ Decision Intelligence platform offers a smarter, data-driven alternative. By aggregating and analysing real-time data, Vision delivers dynamic insights into insurer appetites and broker portfolios, cutting through the limitations of anecdotal communication. Instead of predominantly relying on fragmented, recent conversations, brokers and insurers gain a holistic, long-term view that supports informed, strategic decisions.

Consider the amount of time brokers spend searching for and engaging with insurers that have an appetite for upcoming renewals, often working with outdated information. Vision’s appetite overlays provide a data-driven contemporary view, reducing time spent by up to 30%, speeding up the process while improving the accuracy of placement options.

Additionally, insurers using Vision benefit from greater clarity on market opportunities with brokers with whom they hold an agency. This data-driven approach helps combat the inefficiencies caused by the recency effect and compliments traditional approaches, helping to enhance effectiveness.

With Broker Insights Vision™, brokers gain consistent, real-time insights that foster stronger relationships and reduce missed opportunities. By equipping insurers and brokers with timely information and collaboration tools, Vision transforms how connections are made.

While data is a powerful enabler, it complements rather than replaces human interaction — because, ultimately, people still buy from people. Vision’s data-driven approach allows brokers to work smarter, recognising that outdated static appetite guides are becoming a thing of the past. The future lies in using data to have the right conversation with the right people, at the right time. It’s time to evolve — leverage the power of Vision and take your broker-insurer relationships to the next level.

UK Website

UK Website USA Website

USA Website