Leveraging Broker Insights VisionTM to Rationalise Insurer Markets and Streamline Regulatory Compliance

The introduction of the Financial Conduct Authority’s (FCA) fair value assessment requirements places a significant compliance burden on commercial insurance brokers.

These regulations necessitate rigorous assessment of product value, enhanced data collection, and thorough documentation to ensure that insurance products deliver genuine value to customers.

In this landscape, Broker Insights VisionTM can be a game-changer for brokers looking to simplify their operations and comply efficiently with these new standards.

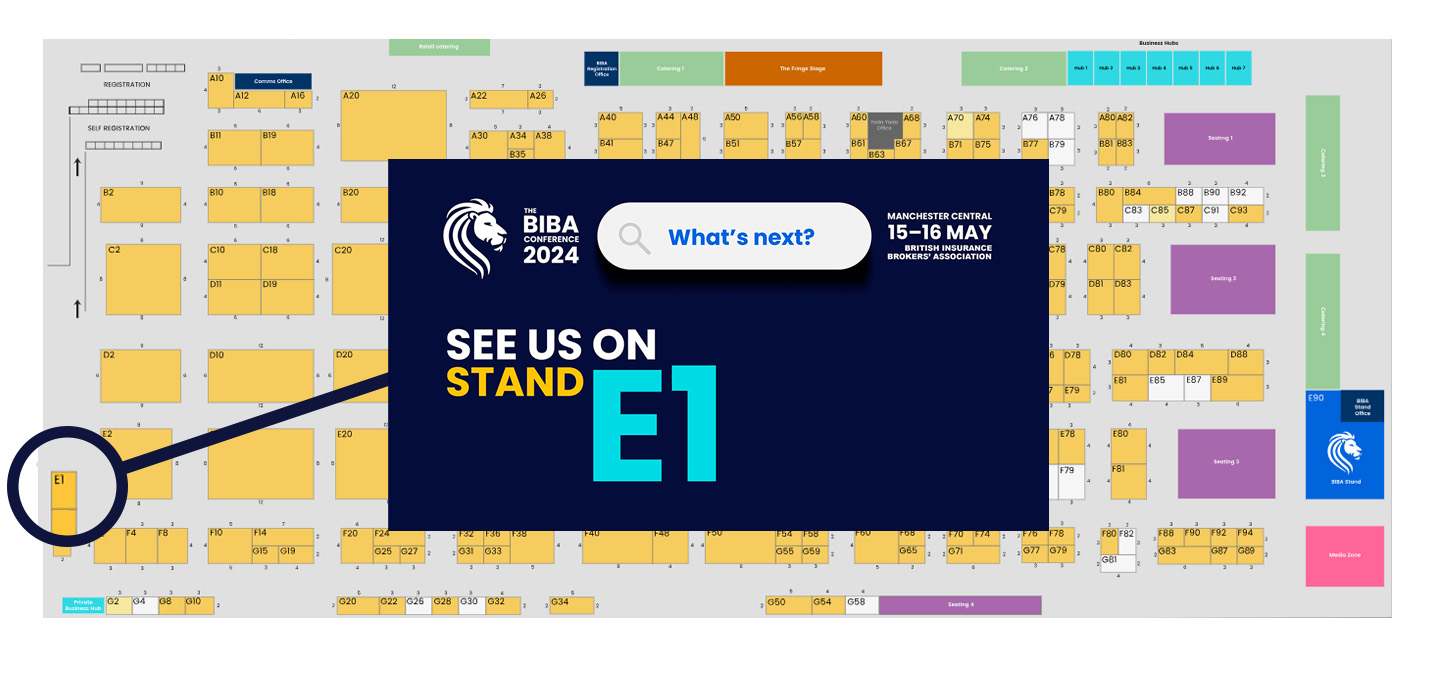

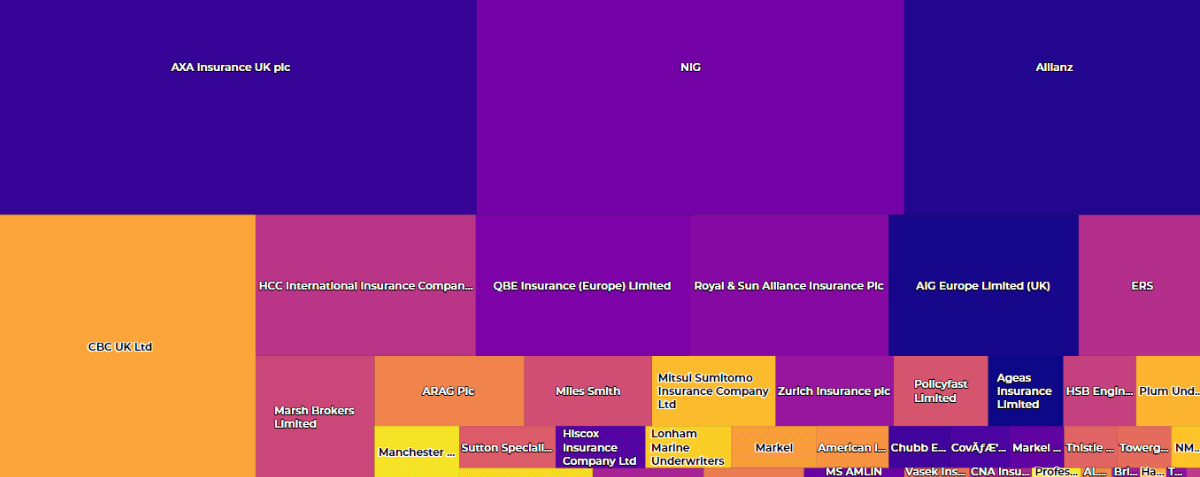

Rationalising Insurer Markets with Broker Insights VisionTM

Broker Insights VisionTM offers a powerful platform to help brokers streamline their insurer partnerships and manage their product portfolios more effectively. Here’s how it can help reduce the regulatory burden:

- Agency Rationalisation: Vision is the market-leading tool for placement optimisation, helping brokers to move business to preferred markets and rationalise barely used agencies. In doing so, not only is the volume of markets being managed by brokers reduced, the utilisation of preferred markets increases, strengthening relationships.

- Reduction in Product Complexity: By rationalising the number of insurer markets, brokers can significantly reduce the number of products they manage. This reduction in product complexity means fewer products need to be assessed and documented for fair value compliance, directly decreasing the regulatory burden. Streamlined product portfolios also enhance the broker’s ability to provide clear and transparent information to customers, aligning with the FCA’s transparency requirements.

- Improved Focus on Customer Needs: With a more manageable product portfolio, brokers can focus on understanding and meeting the needs of their target market. This customer-centric approach not only satisfies regulatory requirements but also builds trust and loyalty among clients.

In the face of stringent regulatory requirements, Broker Insights VisionTM provides commercial insurance brokers with a strategic tool to rationalise and optimise their insurer markets.

By simplifying data management, offering deep market insights, and reducing product complexity, the platform helps brokers streamline their operations and meet the FCA’s fair value assessment standards more efficiently.

Ultimately, this not only reduces the regulatory burden and the risks of non-compliance such as fines and reputational damage; it also enhances the broker’s ability to deliver high-value, customer-focused insurance solutions.

UK Website

UK Website USA Website

USA Website