Our CEO, Fraser Edmond, discusses how technology has kept us connected…

This is a hugely difficult time for everyone, with coronavirus affecting individuals, businesses and society as a whole, and the uncertainty is undoubtedly set to continue. Like others, here at Broker Insights, the health and wellbeing of our team and customers is of primary importance, as we work to continue to support our insurance platform partners and see how the industry can adapt to changing demands and working practices.

It is clear that the insurance industry and its customers are facing many challenges as a result of the coronavirus. Many companies have been significantly impacted and this is having a knock-on impact on our insurance platform partners – regional brokers and insurers.

Regional brokers have had an exceptionally high volume of calls from existing clients to understand their policy terms and, in some cases, reduce their cover. Much of this has happened while the brokers transitioned to home working so they weren’t able to have face-to-face contact with their clients during peak time with many business policies expiring at the end of March. Sadly, some businesses will not survive, meaning a loss of some clients while other businesses will look significantly different, which will result in a new set of challenges.

Our insurance partners have also been inundated with questions about the details of policy cover for this unprecedented pandemic. As insurers typically employ more staff than brokers, the transition to remote working has been even more challenging, especially for the larger insurers, as many had never envisaged a complete UK-wide shutdown of offices.

The economic impact is widespread, with some industries facing an existential crisis. Yet, leaders must navigate their organisations through this period. It is vital they have a clear and up-to-date picture of their portfolios and develop their post-covid-19 strategy.

The insurance sector is working hard to support its customers, yet it finds itself facing reputational damage, particularly among the SME community as the intricacies of policy covers are interpreted in respect of this unprecedented pandemic.

Technology has kept us connected and working

We are living in a more physically and virtually globally connected world, and I do wonder what would have happened, even just ten years ago. Maybe the pandemic wouldn’t have spread so quickly, allowing everyone more time to prepare. Yet one thing is for sure; technology has kept us connected and, for knowledge workers, it has kept us working.

Everyone is becoming more familiar with technology as they connect remotely with family and friends or at work. New ways of working are being adopted. Our habits are changing, and the more we invest in them and the more frequent the actions become, the more likely it is that we are going to change our behaviour in the long term. It’s an escalation of commitment. At work and in our personal lives, those who invest their labour in something associate higher value with their creations.

With possible further waves of the pandemic, targeted lockdowns and ‘track and isolate’ policies likely until a vaccine is available, we are facing the unknown of how these changes in our personal and working lives will continue in a post-covid world.

One thing is sure though: brokers and their clients, and brokers and their insurers will be less physically connected for some time to come. It will make virtual contact, from first-time introductions to regular meetups, and digital interaction more essential and meaningful.

The impact on insurtech companies

With an immediate blow to the economy and the unknown level of ‘bounce-back’, it may be some time before the economy gets back to where it was. Until it does, businesses will likely look to reduce costs and increase efficiency. For example, less travel is likely, even for local business travel as well as international and inter-city travel.

For many startups, just beginning their journey, it will be daunting. Having a clear purpose and vision is always important. And having one that is still relevant and can positively shape and support an industry or sector during and beyond Covid-19 will be even more critical. The government has announced Future Fund to support startups during coronavirus, and Chancellor Rishi Sunak said startups would help power the UK’s growth after the coronavirus crisis. Yet it will still be a challenging time for those looking to raise initial seed investment. Also, for businesses wanting to raise further investment rounds, government investment needs to be matched by private funding and, if not repaid, the government will take an ownership stake in the company. The net effect is the investment threshold will likely rise and those with more viable solutions and stronger propositions will prevail.

How Broker Insights is adapting

Our Broker Insights team of more than twenty are all working fully distributed – we prefer it to the term remote. As an early-stage business and coming from a leading UK insurer background, we knew we wanted to work differently. So when faced with this crisis, we already had a distributed workforce by design and knew how well it can work, and we are finding we are now sharing our experience of effective distributed working. Technology has enabled this new way of working, but it’s not everything.

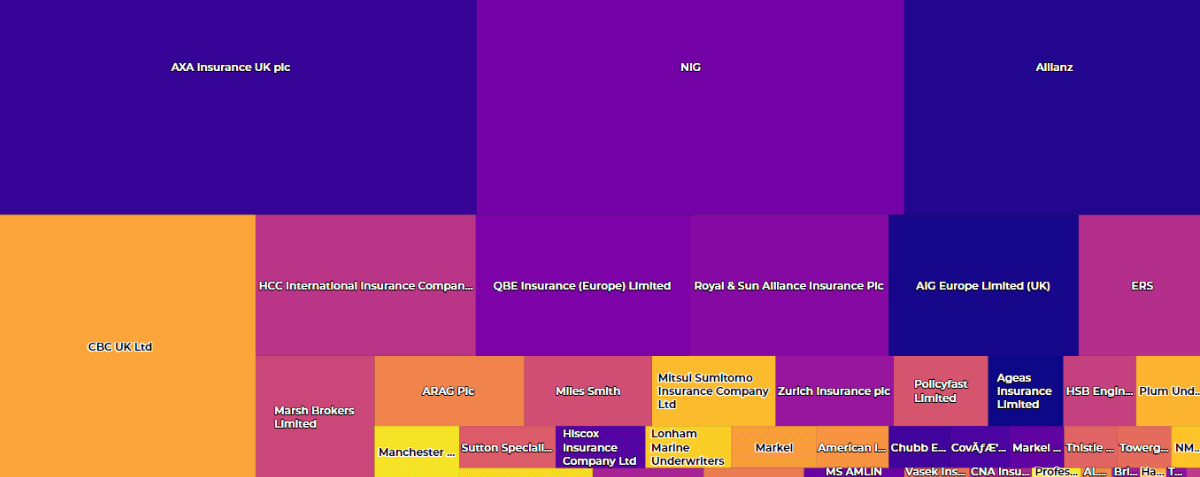

When we designed the Broker Insights platform, our vision was that the technology had to solve a problem, add value and connect people. We want to create value for the partners we serve, and we have built a platform in which value can be created and exchanged. For regional brokers, this means helping them be more visible to insurers and get access to the right solutions for their clients. For insurers, it means they can understand the UK commercial broker market and prospect individual brokers more efficiently. As we facilitate more significant interaction on the platform, we have seen more valuable connections grow between brokers and insurers – connections that are needed in these difficult times more than ever.

We have challenges but have been fortunate, mainly because we have been able to get beyond the initial ‘chicken egg’ challenge with insurers and brokers on both sides of our platform actively using it. I am proud of the team and how they have adapted to change and settled into a new way of working, and grateful to our Board and advisors for their support and guidance throughout.

Looking forward

As for the broader insurance industry, it will come out of this different and there will be more uncertain times ahead, but it will adapt to new ways of working. There will undoubtedly be more use of technology – to help connect – and of real-time data for meaningful interactions. We’re a relationship-based industry and the foundations that Broker Insights are built on to enhance this now seem more relevant than ever.

If you found this of interest, I’ll be exploring some of these issues further in the next article about how we are finding future work positives in the current challenging working practices.

Fraser Edmond, CEO, Broker Insights

UK Website

UK Website USA Website

USA Website