As we approach the Q3/4 period of the year, commercial targets come into focus, particularly where large cases are concerned.

Insurer Sales and Distribution teams know only too well the pressure to achieve growth with larger risks. And for brokers, the complexity of market engagement around more complex business can be equally challenging.

Whether you are a broker or an insurer, when it comes to larger risks with greater complexity involved, if you are going to achieve the desired outcomes within the last two quarters of the year, now is the time to act.

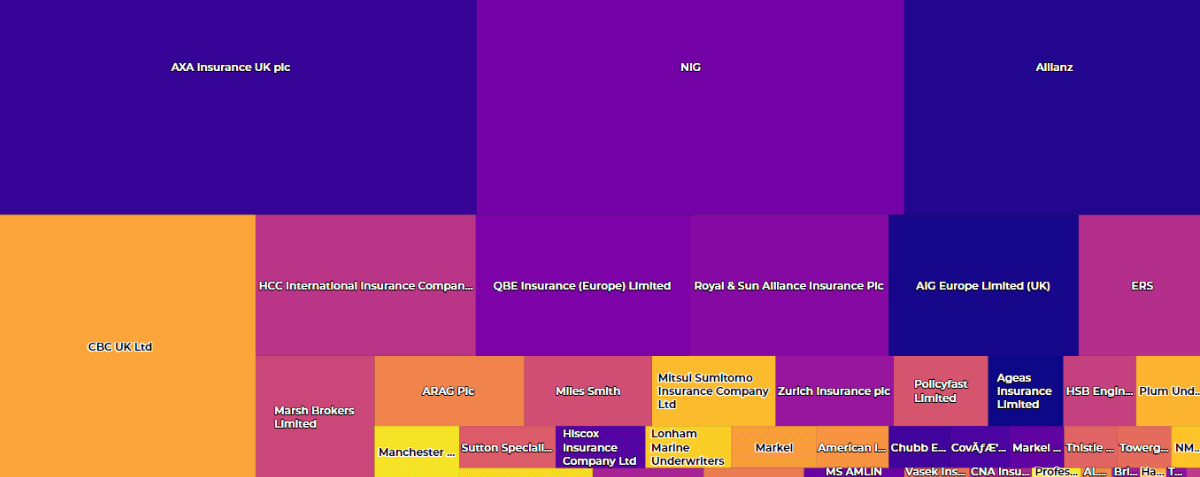

Data Analysis to help capitalise on this sizeable opportunity

Our data team has analysed ‘large’ cases with in-force premiums over £50,000, due for renewal between 1st August and 31st December 2023. They have identified 709 cases on the Broker Insights regional platform held by non-partner markets. The aggregate expiring GWP totals £79.6m within our regional platform, with an average case value of £112,000. Of these 709 cases, 584 are within appetite for our insurer partners. That’s 82% in appetite for partner markets, or £65.3m GWP.

.

Here’s some tips on how to capitalise on this sizeable opportunity:

- For brokers, notes of interest (NOIs), appetite matching, and the newly updated renewal workflows within Broker Insights Vision™ are key. These help to track progress through each stage of the renewal cycle.

- For insurers, actively prospecting within Vision’s market data may well unearth previously unknown opportunities with brokers or facilitate entirely new relationships.

Above all else, working together is key, using data to facilitate meaningful conversations.

The impact of a coordinated approach

Broker Insights Head of Revenue, Alun McGeoghegan, has seen first-hand the impact of a coordinated approach:

“Vision delivers results every day for brokers and insurers, but it is still the large cases that grab the headlines. We have plenty of examples where our technology has allowed an insurer to locate an upcoming risk, engage the broker, and secure the business. Without the input of Vision, these opportunities would be missed.”

“The data analysis completed up until the end of 2023 shows that there is a sizeable opportunity for insurers and brokers to work together, using Vision to facilitate and align their discussions.”

About Broker Insights Vision™

May 2023 marked a significant milestone for Broker Insights as we unveiled our enhanced platform, Broker Insights Vision™. It is set to empower brokers like never before, enabling you to make data-driven decisions, accelerate growth, and enhance customer satisfaction.

If you’d like to know more, email enquiries@brokerinsights.com and follow us on LinkedIn.

UK Website

UK Website USA Website

USA Website