VISION for Brokers

Reveal the best placement opportunities and place more business with key partners.

VISION for Insurers & MGAs

Discover untapped market opportunities, increase your efficiency and boost your bottom line.

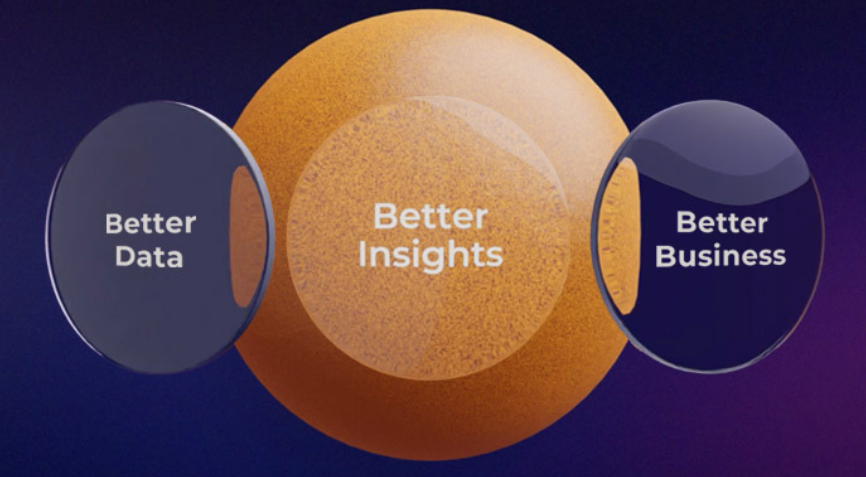

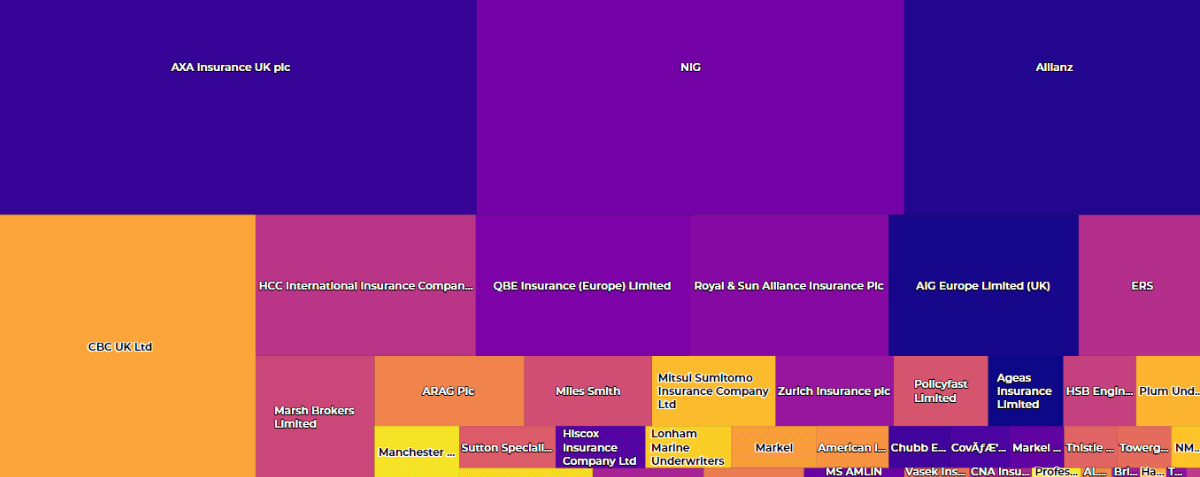

MatchPoints™

MatchPoints™ uses key data points to intelligently match the right broker risk, with the right insurers, at the right time.

Resources

Blog

Keep up to date with the latest industry blog posts.

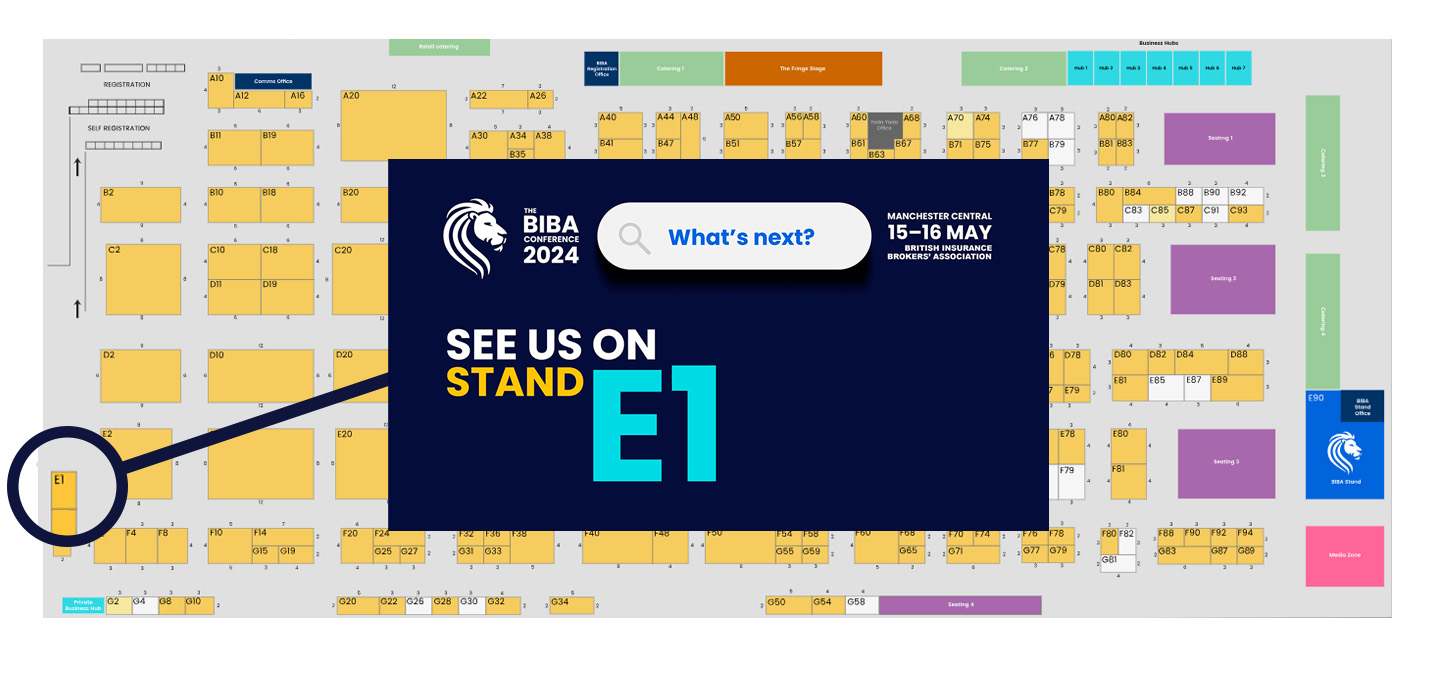

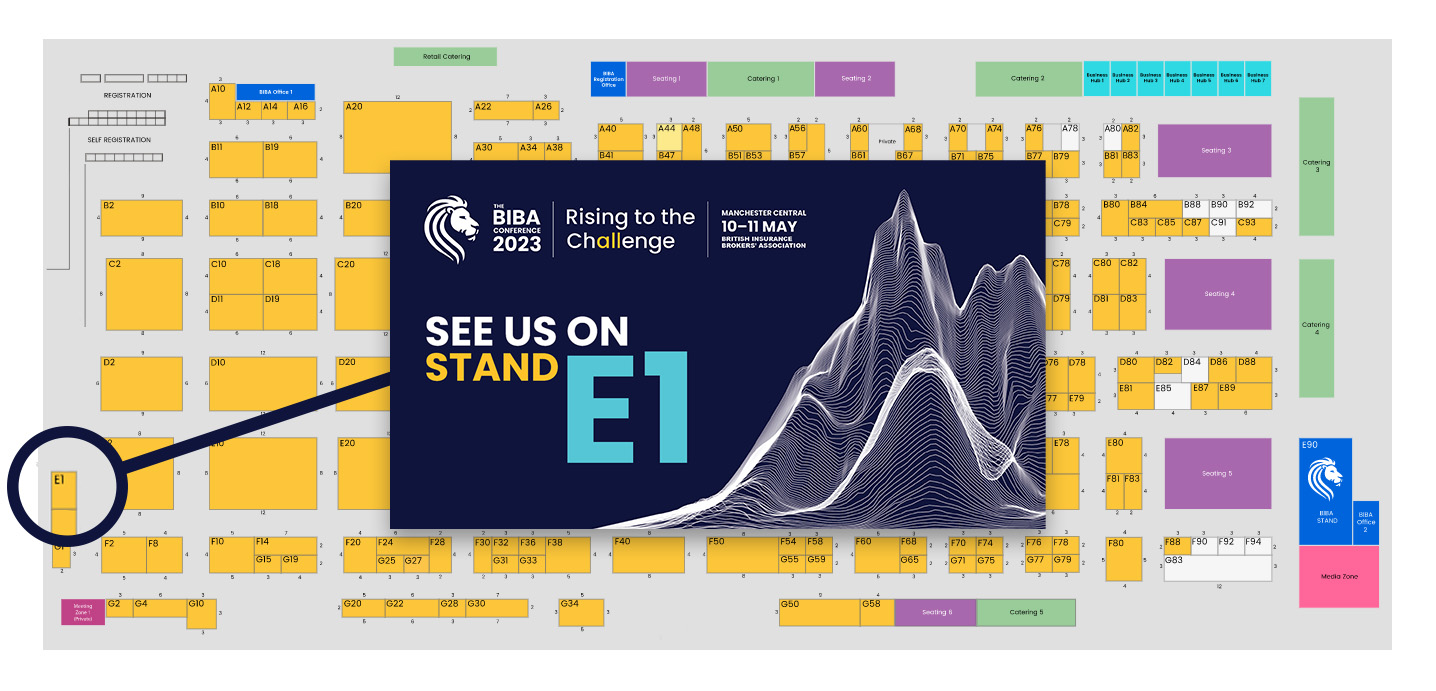

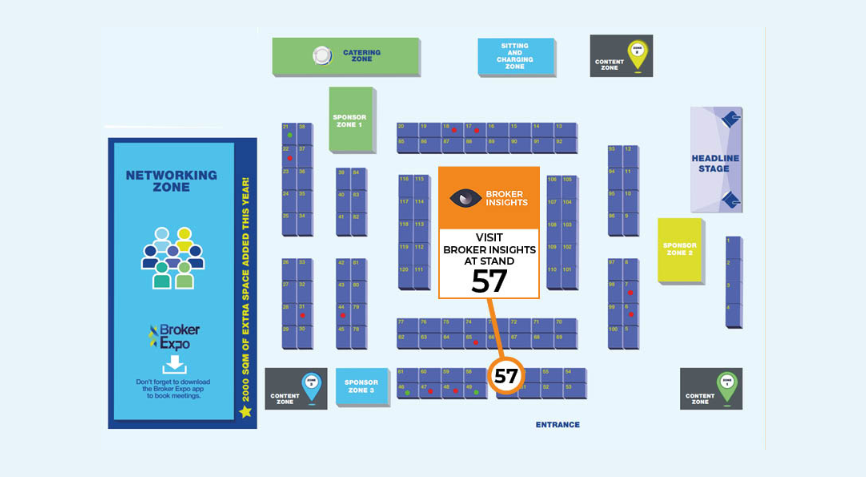

From cutting-edge conferences to must-attend events, we’ve handpicked the key tech and insurance events to...

Case Studies

Hear how our brokers and insurers use VISION.

As an independent, regional broker, James Brown & Sons has served its Somerset community for...

Newsroom

Read about us in the commercial insurance news.

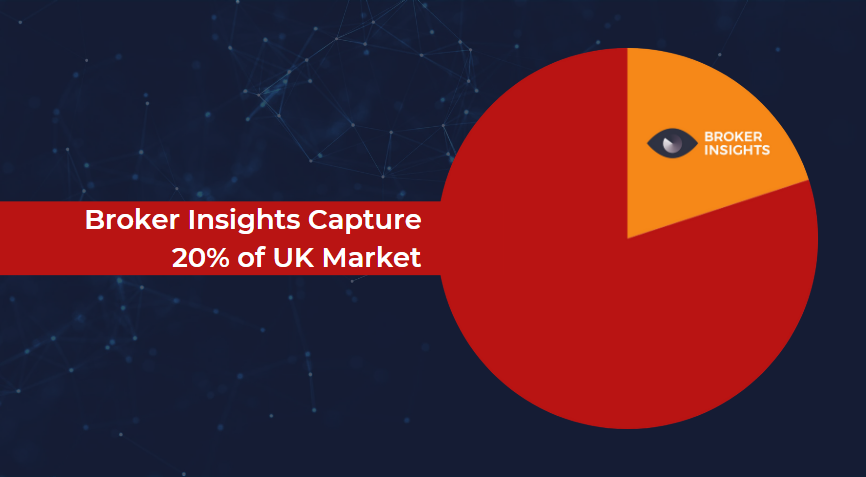

Broker Insights, the Dundee-based insurtech whose platform helps brokers to better understand their business and...

About

Empowering Brokers and Insurers through data-driven decision-making.

Join our Vision for a stronger future in commercial insurance.

UK Website

UK Website USA Website

USA Website