Broker Insights, the leading data and distribution platform that connects UK insurance brokers and insurance companies, has announced that six years after launch, brokers have uploaded £5.5 billion of Gross Written Premium (GWP) to its Vision platform and are on target to hit £6 billion by the end of the year. As a result, Vision will provide market insights and data analytics on over one-third of the UK commercial insurance market alongside its growing European dataset.

Broker Insights brings together brokers, insurers and MGAs on a single platform. An insurer’s risk appetite – the type of risk they want to write – is overlaid with a broker’s customer data, and the Broker Insights’ MatchPoints™ technology uses a range of data points to match both so that the broker receives the right insurance product at the right time.

Broker Insights’ research shows there is c£18 billion of GWP in the UK commercial insurance sector. The platform launched in 2018 with £31 million of GWP, which steadily grew year-on-year, with independent regional brokers and large brokers set to upload more than £6 billion of GWP onto the platform by the end of 2024.

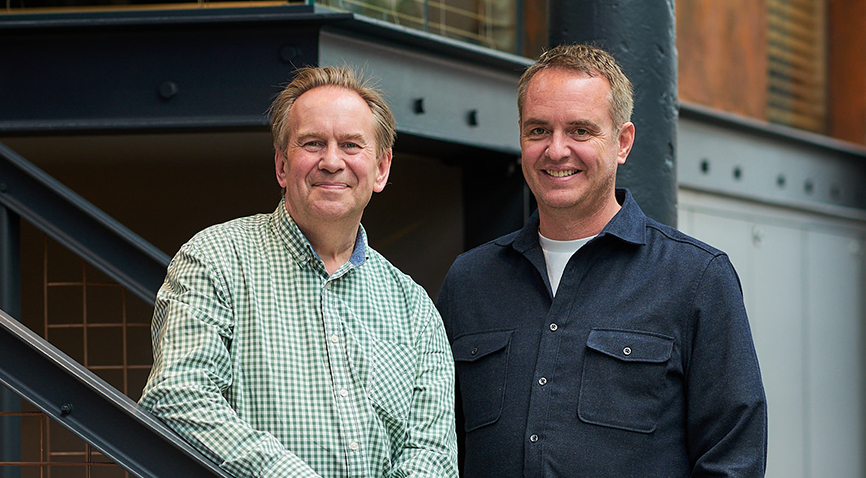

“Our focus from day one was on empowering the commercial insurance industry through data,” said Fraser Edmond, Co-Founder and President of Broker Insights. “We knew that if we could help brokers and insurers make more informed decisions, the entire industry would benefit.”

Fraser added: “What started as a solution for independent, regional brokers to understand their business better and connect with our panel of leading UK insurers is now also being licensed to large national and global brokers, who select their own markets and tailor Vision Enterprise to their needs.”

Broker Insights’ growth has been driven by the platform’s ability to meet market needs through continuous innovation. The company has pioneered the use of Decision Intelligence, enabling users to efficiently explore, simulate, and act on insights that drive measurable improvements in performance.

“The key to our success has been listening to our customers,” said Peter Scott, CEO of Broker Insights. “Innovation isn’t just about technology; it’s about responding to real, everyday challenges that brokers and insurers face. That’s what we’ve built our platform around.

“From inception, Broker Insights has offered a unique platform that enhances information flow, improves efficiency, and drives better decision-making across the insurance value chain. By connecting brokers, insurers, and MGAs on a single platform, Broker Insights has created a more transparent and collaborative environment, leading to enhanced productivity and better outcomes for all parties.”

As Broker Insights celebrates its sixth anniversary this September, the Dundee-based company has expanded its staff to more than 60 employees. This growth supports its ambitious roadmap, which includes new product development, continued expansion within the UK, and an international growth strategy that features launching the platform in the US commercial insurance market.

Broker Insights is also enhancing the platform with the rollout of its AI and machine learning-enabled Propensity Lens. This tool helps insurers assess the likelihood of winning and renewing opportunities by aligning their risk appetite with broker customer data – which improves quote rates, reduces declines, and increases efficiency across sales and underwriting.

UK Website

UK Website USA Website

USA Website