DUNDEE, UK. 15th November, 2023.

Broker Insights, which connects UK insurance brokers and insurance companies, has announced brokers will upload more than £5 billion of annual gross written premium (GWP) this year to its Broker Insights VisionTM platform. This is as a result of a number of brokers and networks signing up to the platform in 2023, and it represents a 400% increase on the £1 billion of GWP on the platform in 2021.

Founded in 2018, Broker Insights’ multi-award-winning Vision platform compiles and standardises UK commercial insurance market data to provide brokers and carriers with a clear view of the insurance landscape.

Partner insurers’ risk appetite – the type of risk they want to write – is overlaid with the broker’s customer data, and Broker Insights MatchPointsTM technology uses multiple data points to match brokers to insurers intelligently and offer the best products at the right time.

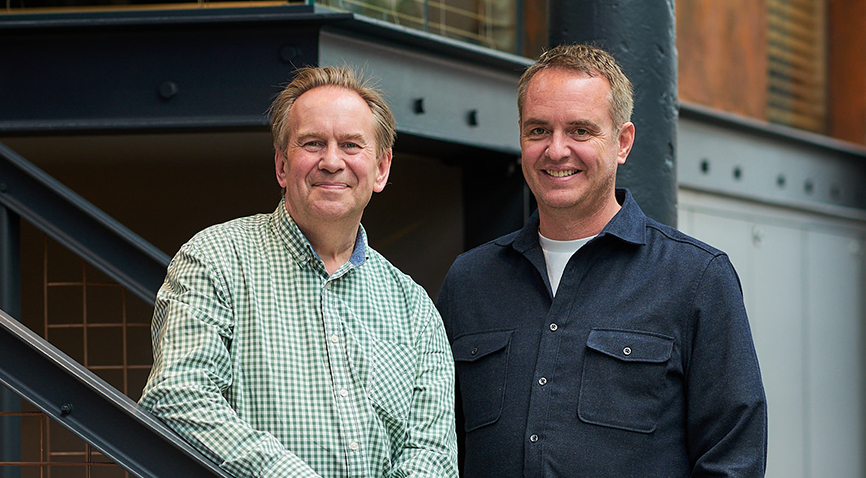

Broker Insights co-founder and Chief Executive Officer, Fraser Edmond, said: “Vision is growing rapidly as brokers and carriers see the tangible value of joining a platform that quickly and efficiently brings them together to do business, saving significant time and money. Our clients appreciate that our unique dataset and increasingly AI-powered technology provides them with real-time business and market insights that enable them to optimise their business models.

In recent weeks, a number of leading insurers including the professional risks division of Tokio Marine HCC joined Broker Insights’ panel of leading UK insurers, giving them access to regional broker opportunities that match their risk appetite.

Fraser added: “What started as a solution for independent, regional brokers to understand their business better and connect with our panel of leading UK insurers is now also being licensed to large national and global brokers, who select their own markets and tailor Vision Enterprise to their needs.

“Looking beyond this latest GWP milestone, the significantly increased dataset enables Broker Insights to deliver valuable market-wide insights on UK commercial insurance market trends. This benefits brokers because it increases the accuracy of our matching processes while simultaneously supporting insurers to improve and optimise sales while increasing efficiency for underwriters.”

“Broker Insights has one of the largest commercial insurance datasets and is the smart solution for brokers and insurers seeking to extend their use of data to improve performance and efficiency.”

UK Website

UK Website USA Website

USA Website